Within the realm of personal finance, few challenges are as pervasive and potentially debilitating as credit card debt. It represents a fundamental divergence from sound financial principles, often acting as a heavy anchor that prevents individuals from making progress toward their goals. While credit cards themselves are neutral tools, offering convenience and consumer protections, the revolving high-interest debt they can generate poses one of the most significant threats to an individual's economic stability and long-term prosperity.The primary danger of

credit card debt lies in its oppressive cost. With interest rates often exceeding twenty percent, carrying a balance means that a significant portion of every minimum payment services only the interest, not the principal. This creates a vicious cycle where the debt can persist for years, with the original purchased items costing far more than their sticker price. This financial drain redirects money that could otherwise be building an emergency fund, growing in a retirement account, or saving for a down payment on a home. It effectively mortgages one's future income, limiting financial flexibility and opportunity.Addressing this debt requires a shift from a spending mindset to a strategic repayment one. The first step is a candid assessment, totaling all balances and their respective interest rates to understand the full scope of the obligation. From there, two common methods are employed: the debt avalanche and the debt snowball. The avalanche method prioritizes paying off the card with the highest interest rate first, minimizing the total interest paid over time. The snowball method focuses on paying off the smallest balance first, creating psychological momentum through quick wins. Both require discipline and, most importantly, a concurrent effort to avoid accumulating new debt.Beyond strategy, overcoming

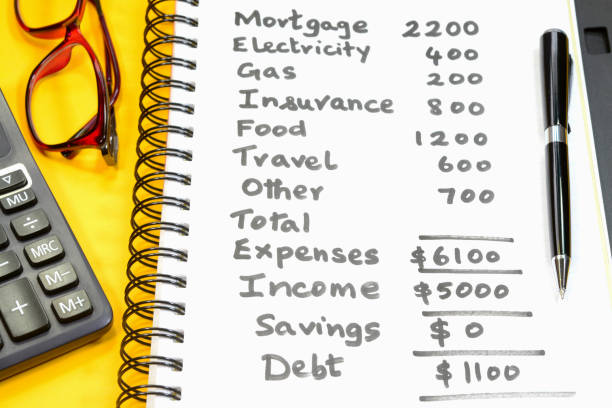

credit card debt often necessitates a return to core financial habits. This involves creating a strict, realistic budget that identifies areas where spending can be reduced to free up more money for debt service. It may require a temporary halt on discretionary spending or finding ways to increase income through side work. The goal is to create the largest possible monthly surplus to attack the debt aggressively.Ultimately, conquering

credit card debt is more than just a financial exercise; it is a reclaiming of autonomy. Eliminating this high-interest burden frees up cash flow, reduces stress, and restores the ability to use income for building wealth rather than servicing past consumption. It is a difficult but transformative journey that lays the groundwork for true financial freedom, allowing individuals to finally direct their money toward the future they envision rather than paying for the past.

Within the realm of personal finance, few challenges are as pervasive and potentially debilitating as credit card debt. It represents a fundamental divergence from sound financial principles, often acting as a heavy anchor that prevents individuals from making progress toward their goals. While credit cards themselves are neutral tools, offering convenience and consumer protections, the revolving high-interest debt they can generate poses one of the most significant threats to an individual's economic stability and long-term prosperity.The primary danger of

Within the realm of personal finance, few challenges are as pervasive and potentially debilitating as credit card debt. It represents a fundamental divergence from sound financial principles, often acting as a heavy anchor that prevents individuals from making progress toward their goals. While credit cards themselves are neutral tools, offering convenience and consumer protections, the revolving high-interest debt they can generate poses one of the most significant threats to an individual's economic stability and long-term prosperity.The primary danger of